- Sold July 48 put in /CL on May 15. Closed the trade on May 29 for a profit of $72.58. Click on the image below to view trade details.

- Sold an Aug 46/73.5 strangle in crude oil on June 1. Close the trade on June 8 for a profit of $155.16. Click on the image below to view trade details.

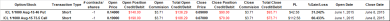

- Sold 2 x July 148/175 strangle in 30-year US treasuries on April 27. Adjusted the trade by selling 2 x July 163 calls on May 19 after being tested on the downside. Sold another 2x July 160 calls as a second adjustment on June 3 as a second adjustment. Closed all 4 legs on June 16 for a profit of $232.10. Click on the image below to view trade details.

- Sold an Aug 48/69 strangle in crude oil on June 15. Close the trade on June 22 for a profit of $115.16. Click on the image below to view trade details.

- Sold 2 x Aug 140/164 strangle in crude oil on June 1. Close the trade on June 22 for a profit of $37.94. Wanted to see how the markets were going to react in relation to the Greek debt crisis. Click on the image below to view trade details.

Tag Archives: /CL (Light Sweet Crude Oil Futures)

/CL trades

Original June short strangle (30.5 put, 62 call) opened on March 23.

– Adjusted by selling another put (43 strike) on April 16 during the large rally.

– Closed the 62 call for a loss on May 7 after that side was being tested. In hind sight if left alone would have expired worthless … of course hind sight being 20/20

– Both the puts (30.5, 43) expired worthless

Opened a short July 72 call on May 8 & closed it on May 15.

Trade details can be viewed by clicking the image below

/CL Short Strangle Adjustment

/CL Open trade setup

SOLD -1 STRANGLE /CLM5 1/1000 JUN 15 /LOM5 62/30.5 CALL/PUT @.35

(scroll to the bottom)

Adjustment – Sold 1 /CL Jun 43 PUT

SOLD -1 /CLM5 1/1000 JUN 15 /LOM5 43 PUT @.11

/GC BWB, /CL & /ZB Short Strangles, /6E remaining call vertical, /ZS IC closing trades, New /CL, /ZB Short Strangles

Closed the trade on Mar 23.

Loss (after commissions) = $329.68

Closed the trade on Mar 23.

Profit (after commissions) = $195.16

Closed the trade on Mar 31.

Profit (after commissions) = $319.20

/6E Partially closed trade setup

Closed the remaining trade on April 2

Profit (after commissions) = $67.28

All legs expired worthless on March 27

Profit (after commissions) = $153.82

Opened Short Strangle in /CL on Mar 16. Opened Short Strangle in /ZB on Mar 19

SOLD -1 STRANGLE /CLM5 1/1000 JUN 15 /LOM5 62/30.5 CALL/PUT @.35

SOLD -2 STRANGLE /ZBM5 1/1000 JUN 15/JUN 15 /OZBM5 178/151 CALL/PUT @0”21

/6E Iron Condor partially closed, /ES Broken Wing Butterfly closing trade, new /CL & /ZB Short Strangles

Bought back the PUT spread tested side on Mar 17.

Loss (after commissions) = $252.94

Closed the trade on Mar 19.

Loss (after commissions) = $669.96

Opened Short Strangle in /CL on Mar 16. Opened Short Strangle in /ZB on Mar 19.

SOLD -1 STRANGLE /CLM5 1/1000 JUN 15 /LOM5 64.5/27.5 CALL/PUT @.42

SOLD -2 STRANGLE /ZBM5 1/1000 JUN 15 /OZBM5 181/149 CALL/PUT @0”23

/ZN Iron Condor & /CL Short Strangle Closing Trades

/ZN Opening setup/trade (Feb 11, 2015)

Scroll to the bottom of the post

Closed the trade for 0”03 debit

Closing trade

P&L Table

Profit = $44.64

/CL Opening setup/trade (Mar 05, 2015)

Scroll to the bottom of the post

Closed the trade for 0.20 debit

Closing trade

P&L Table

Profit = $195.16

/CL (Light Sweet Crude Oil Futures) Short Strangle: 2/24/2015 Closing Trade + New /CL (Light Sweet Crude Oil Futures) Short Strangle: 3/5/2015

/CL Opening setup/trade (Feb 25, 2015)

Scroll to the bottom of the post

SOLD -1 STRANGLE /CLK5 1/1000 MAY 15 /LOK5 67/30 CALL/PUT @.43

Closed the trade for 0.22 debit

Closing trade

Profit = $430 (credit collected from opening trade) – $220 (debit for buying back the strangle) = $210

Total commissions (opening & closing) = $14.84

Profit incl. commissions = 210 – 14.84 = $195.16

SOLD -1 STRANGLE /CLK5 1/1000 MAY 15/MAY 15 /LOK5 65/35 CALL/PUT @.41

Neutral bias

Order

Note: Commissions not included

Max. Profit = $410.00

Max Loss = $Infinite

Initial buying power reduction (BPR) =~ $1,500

Note: Unlike an Iron Condor the BPR for a short strangle can change drastically if the underlying makes a significant move either way. Options on futures require low margin to start off with (use span magin). The wings I bought were around a 5 delta (around 2 STD out each way). However, this trade might require active management to keep deltas in check or the losses could be significant.

DTE = 42

BE = 34.58 & 65.36

POP =~ 88%

Max ROC = 430/1,500 =~ 29%

Would look to take this off around 30%-40% of max. profit.

P&L diagram

Chart

/GC (Gold Futures) Broken Wing Butterfly: 1/6/2015 & /CL (Light Sweet Crude Oil Futures) Iron Condor: 2/2/2015 Closing Trades + New /CL (Light Sweet Crude Oil Futures) Short Strangle: 2/24/2015

/GC Opening setup/trade & adjustment (Jan 6, 2015)

/GC was trading right around the max profit level of 1200. However, I did not want any ITM legs to get exercised and be assigned the associated short or long futures position. As such I sold the remaining regular butterfly (1210/1200/1190).

SOLD -1 BUTTERFLY /GCJ5 1/100 MAR 15 /OGH5 1210/1200/1190 PUT @3.00

Order

Profit = $140 (credit collected from opening trade) – $30 (debit for buying back the embedded short put vertical) + $300 (credit collect from closing out the remaining butterfly) = $410

Total commissions (opening & closing) = $37.10

Profit incl. commissions = 410 – 37.10 = $372.90

/CL Opening setup/trade (Feb 2, 2015)

Closing trade

BOT +1 IRON CONDOR /CLJ5 1/1000 APR 15 /LOJ5 60/61/40/39 CALL/PUT @.12

Debit = $120

Profit = $240 (credit collected from opening trade) – $120 = $120

Total commissions (opening & closing) = $29.68

Profit incl. commissions = 120 – 29.68 = $90.32

SOLD -1 STRANGLE /CLK5 1/1000 MAY 15 /LOK5 67/30 CALL/PUT @.43

Neutral bias

Order

Note: Commissions not included

Max. Profit = $430.00

Max Loss = $Infinite

Initial buying power reduction (BPR) =~ $1,100

Note: Unlike an Iron Condor the BPR for a short strangle can change drastically if the underlying makes a significant move either way. Options on futures require low margin to start off with (use span magin). The wings I bought were around a 5 delta (around 2 STD out each way). However, this trade might require active management to keep deltas in check or the losses could be significant.

DTE = 52

BE = 29.57 & 67.43

POP =~ 63%

Max ROC = 430/1,100 =~ 39%

Would look to take this off around 30%-40% of max. profit.

P&L diagram

Chart

/CL (Light Sweet Crude Oil Futures) Iron Condor: 2/2/2015

SOLD -1 IRON CONDOR /CLJ5 1/1000 APR 15 /LOJ5 60/61/40/39 CALL/PUT @.24

Neutral bias

Order

Note: Commissions not included

Max. Profit = $240.00

Max Loss = $760.00

DTE = 43

BE = 39.77 & 60.23

POP =~ 71%

Max ROC = 240.00/760.00 =~ 31.5%

Tgt. ROC (@ 50% of max. profit) = 120/760 =~ 15.80%

/CL (Light Sweet Crude Oil Futures) Iron Condor: 1/5/2015 – Closing Trade

Opening setup/trade (Jan 5, 2015)

Closing trade

BOT +1 IRON CONDOR /CLH5 1/1000 MAR 15 /LOH5 61/62/42/41 CALL/PUT @.13

Debit = $130

Profit = $260 (credit collected from opening trade) – $130 = $130

Total commissions (opening & closing) = $29.68

Profit incl. commissions = 130 – 29.68 = $100.32